CFPB Weighs In on Withholding Academic Transcripts

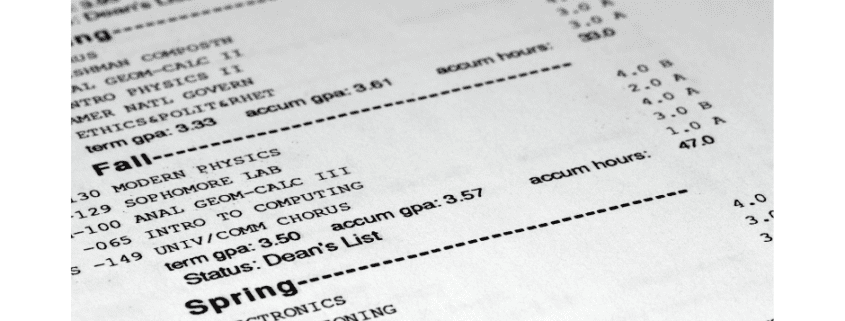

Withholding academic transcripts for outstanding student account or loan balances has been a primary debt collection tool for many years. Though recently under fire as harming many students (see our March 2022 Tip), this issue is drawing attention both from state regulators and legislators and, now, from the federal Consumer Financial Protection Bureau (CFPB). While 16 states have enacted laws or are proposing legislation to halt or reduce the campus practice, which is seen as inhibiting students’ academic careers or employment opportunities, the federal agency’s recent Supervisory Highlights report cites the “blanket” usage of the transcript sanction as unlawful.

The recent report came on the heels of an announcement earlier this year that the agency would examine operations of colleges that act as lenders. In this case, the CFPB has interpreted student accounts as a form of lending or credit offered to students by schools. While definitions may be subtle or subject to various interpretations, the CFPB report links transcript withholding to provisions under the Dodd-Frank Act, which prohibits unfair, deceptive or abusive acts and practices (UDAAP) because of potential financial injury to consumers.

Though the CFPB cannot enact laws, it has rulemaking and enforcement authority to deal with any consumer financial product or service. The agency also partners with other federal departments on many financial initiatives, and could work with the U.S. Department of Education to potentially promulgate new rules or guidelines.

Senior leadership at colleges and universities should have this issue on their radar from both a service delivery and compliance perspective. Presidents, chief financial officers, registrars and enrollment management leaders need to understand and weigh their existing policies and procedures on withholding academic transcripts and other services. A joint statement signed this month by 22 higher education associations urges college leaders to “have a clear understanding of institutional policies regarding transcript and enrollment holds, and be prepared to explain how they determined these policies to be effective and fair.”

In states where no restrictions currently exist, government relations staff should be monitoring legislative activities since constituent complaints have often led to proposed laws. In other cases, complaints to state attorneys general may trigger new rules or legislation.

Institutions also should engage their general counsel or an outside attorney to help interpret these laws and requirements and adjust their business practices and policies to become and/or remain in compliance. Bringing institutional resources together to review and update policies and procedures can have a positive outcome for students and finances with minimal impact on institutional resources. The National Association of College and University Business Officers (NACUBO) and the American Association of Collegiate Registrars and Admissions Officers (AACRAO) provided guidelines for schools to consider in an April 2022 statement.